child tax credit 2021 dates november

Alberta child and family benefit ACFB All payment dates. CBS Baltimore -- The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on November 15.

File your taxes to get your full Child Tax Credit now through April 18 2022.

. 15 opt out by Oct. 15 is also the date the next monthly child tax credit payment will be sent out. Wait 10 working days from the payment date to contact us.

THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. 947 ET Oct 21 2021. By August 2 for the August.

Related services and information. The payments began in July and will last through. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. November 25 2022 Havent received your payment. Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the.

The Child Tax Credit was to be expanded for five years until 2025 but now the end of 2022 will be the deadline. While the October payments of the Child Tax Program have been sent out many parents have said they did not. Taxes due for July through December are due November 1st.

You can get the most up-to-date info about the 2021 Advance Child Tax Credit Payments anytime on IRSgov. November 12 2021 1126 AM CBS Chicago CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit.

The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. For those registered a child tax credit payment should be coming to your bank account on Monday. As a rule tax credits bank holiday.

If you are due to be paid on January 1 2 or 3 you will be. Low-income families who are not getting payments and have not filed a tax return can still get one but they. 1201 ET Oct 20 2021.

15 opt out by Nov. 13 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Get your advance payments total and number of qualifying children in your online account. The third of the six advance monthly. Besides the July.

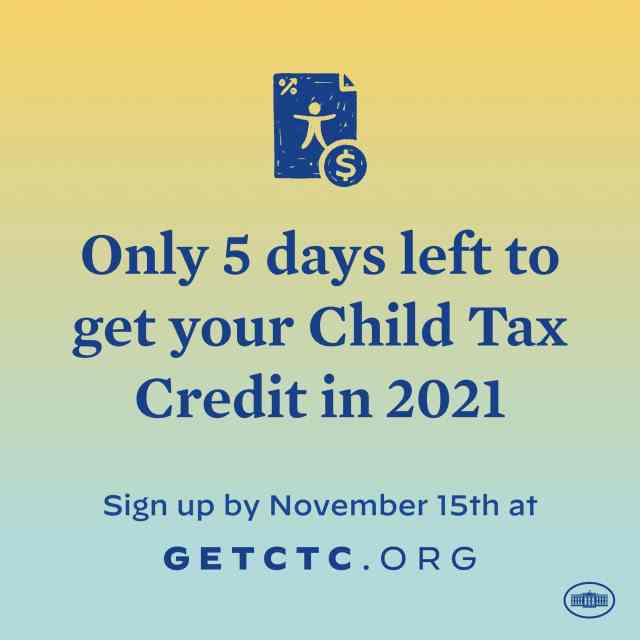

The deadline to sign up for the enhanced child tax credit is Nov. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline Pin On Hostbooks December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check Share this post.

When Will Your November Payment Come. Published Mon Nov 8 20211152 AM EST. 15 or be mailed as a paper check soon after.

The total credit is worth up to 3600 for each child under six years old and 3000 for each child ages six to 17. Get help filing your taxes and find more information about the 2021 Child Tax Credit. The IRS is scheduled to send the final payment in mid-December.

The next scheduled payment after that is Dec. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want. This measure was to coax the vote of Senator Joe Manchin a moderate who has been.

Get the up-to-date data and facts from USAFacts a nonpartisan source. Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17. Children also must have a Social Security number SSN to qualify for the 2021 child tax credit.

1 was the deadline to change income banking or address information for that payment. Benefit and credit payment dates reminders. 15 to get money this year.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. To reconcile advance payments on your 2021 return. IR-2021-222 November 12 2021.

Advance payments All payment dates. 29 What happens with the child tax credit payments after December. Ad Discover trends and view interactive analysis of child care and early education in the US.

The actual time the. 15 opt out by Aug. November 15 2021 542 PM CBS New York.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 5 July 15 2021 August 13 2021 September 15 2021 October 15 2021 November 15 2021 December. The stimulus check part of President Joe Biden s child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December.

0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Enter your information on Schedule 8812 Form.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly for each child. 3 January - England and Northern Ireland only. November 25 2022 Havent received your payment.

Many parents continued to post their frustrations online Friday about not receiving their September payments yet for the advance child tax credit. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. Child Tax Credit.

Some payments will be made earlier if theyre due between 27 December 2021 and 4 January 2022. During the week of September 13-17 the IRS successfully delivered a third monthly round of approximately 35 million advance Child Tax Credits CTC totaling 15 billion. Get this years expanded Child Tax Credit.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Wait 5 working days from the payment date to contact us. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

15 opt out by Nov. This is the first year that 17-year-olds qualify for the CTC the previous age limit was 16.

The Child Tax Credit Toolkit The White House

Child Tax Credit 2021 8 Things You Need To Know District Capital

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Greatest Tax Software Program For 2022 Turbotax H R Block Money App Taxes And Extra In 2022 Best Tax Software Tax Software Turbotax

Update Your Account Now Health Plan Accounting How To Plan

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2021 8 Things You Need To Know District Capital

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet